In a post-bubble world, buying a home may not seem like the easy decision it once was, but that doesn’t mean that it isn’t the right one.

After falling for several years, national inflation-adjusted housing prices are now back to where they were in 1999, before the bubble was inflated. And according to the FNC Residential Price Index, homes in the greater Chicago area have just experienced their first consecutive months of roughly 2% gains in value since peaking in June of 2007. Now that the market has corrected, smart buyers are taking advantage of great deals before prices resume the steady growth that was the hallmark of pre-bubble housing, and they’re doing it when the cost of a mortgage has never been lower.

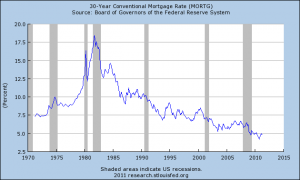

Thanks to government efforts to rejuvenate the economy, interest rates that are hovering near all-time lows. The extraordinary measures that are forcing rates down are creating a once-in-a-lifetime opportunity to pay less for your mortgage than at any other time in decades:

If rates only return to their post-WWII average, buyers who wait will have missed out on the opportunity to cut their interest payments in half. Over the life of a mortgage, those savings add up to tens of thousands of dollars—dollars that could allow you to afford the home of your dreams if you act now.

There’s no better way to take advantage of today’s circumstances than with Newport Cove’s 10-year hybrid ARM loan. Interest for the first two years is locked in at an incredibly low 2.5%, and for the first ten years, it can never go higher than 4.5%. It may be decades before rates are this low again. Don’t miss out on the chance to take advantage of them for years to come.